Best Checking Accounts

Based on In-Depth Reviews

- 200+Hours of research

- 40+Sources used

- 20Companies vetted

- 3Features reviewed

- 10Top

Picks

- Online banking has lower fees and higher interest rates

- Some banks have a minimum balance and withdrawal limits

- Choose a bank that offers ATM or service fee refunds

- Test the website to determine its user-friendliness

How we analyzed the best Checking Accounts

Our list of the best Checking Accounts

- Additional Companies:

- Current

- Alliant Credit Union

- Bank of America

- Barclays Bank Savings Account

- Sofi Checking and Savings

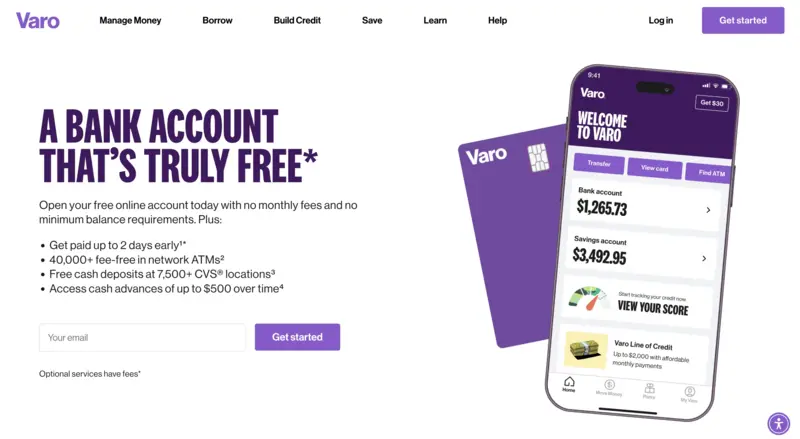

- Varo

- BMO Bank

- CIT Bank

- Truist

- SoFi High Yield Savings

- CIT Bank Platinum Savings

- Key Smart

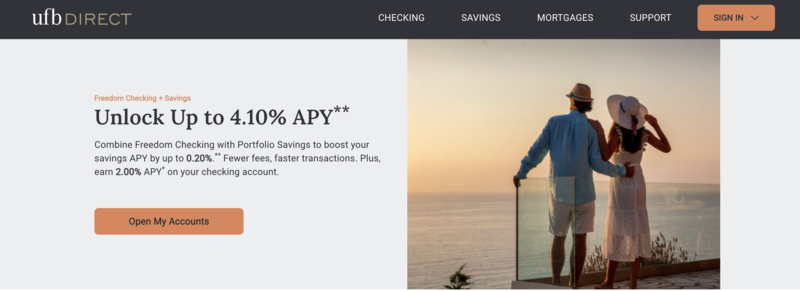

- UFB Freedom Checking + Savings

- chime-sponsorship

- etradechecking

- Capital One

- Chase Bank

- U.S. Bank

- Bank of Internet

- Wells Fargo

- Citibank Priority Account

- Bank5 Connect

- PNC Virtual Wallet Pro

- EverBank

- USAA Checking Accounts

- Schwab.com

- nbkc Everything Account

- Discover™ Online Savings Account

- Simple

- BBVA Free Checking

- Axos Bank

- Huntington Personal Checking

- PenFed

- BBVA Premium Checking

- Lending Club

- M&T Bank

- Acorns

- Level

- Wealthfront

- PNC Virtual Wallet Student

- TD Bank Beyond Checking

- PNC Virtual Wallet®

- Lili

- Quontic

- Upgrade Checking Account

- EarnIn

- Axos Bank

- SoFi Plus Checking Accounts

- Empower Finance

SoFi's Disclaimers:

1. Up to $300 Bonus Tiered Disclosure

New and existing Checking and Savings members who have not previously enrolled in Direct Deposit with SoFi are eligible to earn a cash bonus of either $50 (with at least $1,000 total Eligible Direct Deposits received during the Direct Deposit Bonus Period) OR $300 (with at least $5,000 total Eligible Direct Deposits received during the Direct Deposit Bonus Period). Cash bonus will be based on the total amount of Eligible Direct Deposit. If you have satisfied the Eligible Direct Deposit requirements but have not received a cash bonus in your Checking account, please contact us at 855-456-7634 with the details of your Eligible Direct Deposit. Direct Deposit Promotion begins on 12/7/2023 and will be available through 1/31/2026. Full terms at sofi.com/banking. SoFi Checking and Savings is offered through SoFi Bank, N.A. Member FDIC.

SoFi members with Eligible Direct Deposit can earn 3.30% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Eligible Direct Deposit amount required to qualify for the 3.30% APY for savings (including Vaults). Members without Eligible Direct Deposit will earn 1.00% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Interest rates are variable and subject to change at any time. These rates are current as of 12/23/25. There is no minimum balance requirement. Fees may reduce earnings. Additional information can be found at https://www.sofi.com/legal/banking-rate-sheet.

2. APY Disclosures

Annual percentage yield (APY) is variable and subject to change at any time. Rates are current as of 12/23/25. There is no minimum balance requirement. Fees may reduce earnings. Additional rates and information can be found at https://www.sofi.com/legal/banking-rate-sheet

3. Fee Policy

We do not charge any account, service or maintenance fees for SoFi Checking and Savings. We do charge a transaction fee to process each outgoing wire transfer. SoFi does not charge a fee for incomingwire transfers, however the sending bank may charge a fee. Our fee policy is subject to change at any time. See the SoFi Bank Fee Sheet for details at sofi.com/legal/banking-fees/.

4. Additional FDIC Insurance

SoFi Bank is a member FDIC and does not provide more than $250,000 of FDIC insurance per depositor per legal category of account ownership, as described in the FDIC’s regulations. Any additional FDIC insurance is provided by the SoFi Insured Deposit Program. Deposits may be insured up to $3M through participation in the program. See full terms at SoFi.com/banking/fdic/sidpterms. See list of participating banks at SoFi.com/banking/fdic/participatingbanks.

5. ATM Access

We’ve partnered with Allpoint to provide you with ATM access at any of the 55,000+ ATMs within the Allpoint network. You will not be charged a fee when using an in-network ATM, however, third-party fees may be incurred when using out-of-network ATMs. SoFi’s ATM policies are subject to change at our discretion at any time.

6. Early Access to Direct Deposit Funds

Early access to direct deposit funds is based on the timing in which we receive notice of impending payment from the Federal Reserve, which is typically up to two days before the scheduled payment date, but may vary.

7. Overdraft Coverage

Overdraft Coverage is a feature automatically offered to SoFi Checking and Savings account holders who receive at least $1,000 or more in Eligible Direct Deposits within a rolling 31 calendar day period on a recurring basis. Eligible Direct Deposit is defined on the SoFi Bank Rate Sheet, available at https://www.sofi.com/legal/banking-rate-sheet. Members enrolled in Overdraft Coverage may be covered for up to $50 in negative balances on SoFi Bank debit card purchases only. Overdraft Coverage does not apply to P2P transfers, bill payments, checks, or other non-debit card transactions. Members with a prior history of unpaid negative balances are not eligible for Overdraft Coverage. Eligibility for Overdraft Coverage is determined by SoFi Bank in its sole discretion. Members can check their enrollment status, if eligible, at any time by logging into their account through the SoFi app or on the SoFi website.

8. 0.70% Savings APY Boost

Earn up to 4.00% Annual Percentage Yield (APY) on SoFi Savings with a 0.70% APY Boost (added to the 3.30% APY as of 12/23/25) for up to 6 months. Open a new SoFi Checking and Savings account and pay the $10 SoFi Plus subscription every 30 days OR receive eligible direct deposits OR qualifying deposits of $5,000 every 31 days by 1/31/26. Rates variable, subject to change. Terms apply at sofi.com/banking#2. SoFi Bank, N.A. Member FDIC.

CIT's Disclaimers:

1The Annual Percentage Yields (APY) and interest rates are effective as of December 15, 2025. Fees may reduce earnings. Checking APYs and interest rates are variable and may change at any time without prior notice, including after account opening. The minimum opening deposit for eChecking is $100. See Fee Schedule and Agreement for Personal Accounts for details. To obtain the interest rate and APY disclosed, the minimum balance for the applicable balance tier must be maintained.

Must have a bank account in the U.S. to use Zelle. Transactions typically occur in minutes when the recipient’s email address or U.S. mobile number is already enrolled with Zelle. Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used

herein under license. The Apple Pay logo and Apple are registered trademarks of Apple Inc. The Samsung Pay logo and Samsung are registered trademarks of Samsung Electronics Co., Ltd.

For complete list of account details and fees, see our Personal Account disclosures.

Chime Disclaimers:

Chime® is a financial technology company, not a bank. Banking services provided by The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC.

^Early access to direct deposit funds depends on the timing of the submission of the payment file from the payer. We generally make these funds available on the day the payment file is received, which may be up to 2 days earlier than the scheduled payment date.

*Terms apply. Limited time only, must open the new account and complete qualifying activities to earn 3 individual rewards, up to a max of $350.00, as described at https://www.chime.com/policies/newmemberofferv3.

~Out of network ATM withdrawal and over the counter advance fees may apply except at MoneyPass ATMs in a 7-Eleven, or any Allpoint or Visa Plus Alliance ATM.

1SpotMe on Debit is an optional, no fee overdraft service attached to your Chime Checking Account. To qualify for the SpotMe on Debit service, you must receive $200 or more in qualifying direct deposits to your Chime Checking Account each month and have activated your physical Chime Visa

Debit Card or secured Chime Visa

Credit Card. Qualifying members will be allowed to overdraw their Chime Checking Account up to $20 on debit card purchases and cash withdrawals initially but may later be eligible for a higher limit of up to $200 or more based on Chime Account history, direct deposit frequency and amount, spending activity and other risk-based factors. The SpotMe on Debit limit will be displayed within the Chime mobile app and is subject to change at any time, at Chime's sole discretion. Although Chime does not charge any overdraft fees for SpotMe on Debit, there may be out-of-network or third-party fees associated with ATM transactions and fees associated with OTC cash withdrawals. SpotMe on Debit will not cover any non-debit card transactions, including ACH transfers, Pay Anyone transfers, or Chime Checkbook transactions. SpotMe on Debit Terms and Conditions.

Current Disclaimers:

1Fees may apply, including out of network cash withdrawal fees, third-party fees, cash load fees, inactivity fees, account closure fees, international transaction fees, replacement card fees, express mail fees and escheatment fees.

2For eligible customers only. Your actual available Paycheck Advance amount will be displayed to you in the mobile app and may change from time to time. Conditions and eligibility may vary and are subject to change at any time, at the sole discretion of Finco Advance LLC, which offers this optional feature. Finco Advance LLC is a financial technology company, not a bank. For more information, please refer to Paycheck Advance Terms and Conditions.

E*trade Disclaimers:

1. To be eligible for this offer, you must apply promo code CHECKING25 at the time of account opening. This promo code is intended for single use only, is non-transferable, and

is only valid for a new individual or joint Checking or Max-Rate Checking account. Not valid if you’ve had either account in the past 12 months. U.S. residents only. Only one

account type eligible; if both are opened, Checking will be enrolled. Account must be funded within 30 days. To qualify, receive two Direct Deposits of $1,500+ each to your

enrolled account within 90 days of opening. Direct Deposits must be recurring income via ACH (e.g., payroll, government benefits). Wires, checks, P2P, Zelle®, transfers, etc.

are not eligible forms of direct deposit. Bonus paid ~120 days after account opening if requirements are met and account is in good standing. Offer cannot be combined, may

be removed at any time, and other restrictions may apply.

2. The $15 monthly account fee can be waived when you maintain an average monthly balance of at least $5,000 in the Max-Rate Checking account on or after the end of the

second calendar month from opening the account.

3. As of 01/07/2026, the Annual Percentage Yield (APY) of the Max-Rate Checking Account is 2.00%. Your interest rate and APY may change at any time and fees may

reduce earnings. Please visit etrade.com/ratesheet for information regarding this account's current interest rate and corresponding APY.

4. Deposits held in checking accounts are FDIC insured to at least $250,000.

Our Top Picks: Checking Accounts Reviews

Chime®️ Checking Account Overview:

Chime’s®️ Checking Account is a modern, mobile-first account designed for everyday banking without the hassle of traditional branches. It comes with a Visa® debit card and full access through Chime’s intuitive mobile app, making money management easy and accessible from anywhere.

Account Fees:

Chime does not charge monthly maintenance fees, overdraft fees, or minimum balance penalties. However, third-party fees may apply for out-of-network ATM use or cash deposit services at retail locations.

Perks & Benefits:

Chime offers a variety of standout features including early direct deposit (up to two days faster), SpotMe® fee-free overdraft for eligible members1, and access to over 47,000 fee-free ATMs. The account also includes real-time transaction alerts, automatic savings tools, and no foreign transaction fees, all backed by FDIC insurance through partner banks.

Current Checking Account Overview:

Current makes banking simple with a quick online sign-up process—no credit check required. Your Visa® debit card will arrive within a few business days, and you can start using your account right away. Eligible users can access their paycheck up to 2 days early with direct deposit.

Account Fees:

No monthly fees, no minimum balance requirements, and no overdraft fees. Eligible users can overdraft up to $200 fee-free with Current Overdrive™. Standard transactions, such as ATM withdrawals at in-network locations, are also free.

Perks & Benefits:

Current offers cash back on debit card purchases at participating retailers. Users can also create Savings Pods to organize and grow their savings with competitive interest. The app provides real-time spending insights, instant transaction alerts, and quick money transfers to friends. Plus, with access to over 40,000 fee-free ATMs nationwide, you can withdraw cash without extra charges. All accounts are FDIC-insured up to $250,000 through Choice Financial Group, Member FDIC.

Alliant High-Rate Checking Account Overview:

The Alliant High-Rate Digital Checking Account is built for those who want a modern, no-frills approach to managing their money. With a fully digital experience and easy account access through Alliant’s top-rated mobile app, it's a smart choice for everyday banking.

Account Fees:

There are no monthly service fees, no minimum balance requirements, and no overdraft or non-sufficient funds (NSF) fees. Alliant also reimburses up to $20 per month in out-of-network ATM fees when you meet basic account requirements.

Perks & Benefits:

Earn 0.25% APY* on your checking balance when you opt for eStatements and have at least one electronic deposit per month. The account includes contactless debit cards, mobile check deposit, Zelle® transfers, and access to 80,000+ surcharge-free ATMs nationwide.

SoFi Checking & Savings Account Overview:

SoFi Checking & Savings offers an all-in-one banking experience with no monthly fees and a fast online sign-up process. Customers can open an account in minutes and enjoy features like early direct deposit, automatic savings tools, and a high-yield interest rate on their balance. Accounts are FDIC-insured up to $3 million through SoFi Bank, N.A.

Account Fees:

SoFi Checking & Savings has no monthly maintenance fees, no overdraft fees, and no minimum balance requirements. Customers who set up direct deposit can qualify for fee-free overdraft protection up to $50. ATM withdrawals are free at over 55,000 Allpoint® locations nationwide.

Perks & Benefits:

SoFi members can earn up to 3.30% APY on savings and 0.50% APY on checking balances with direct deposit.1 Additional perks include financial planning tools and exclusive member rewards. SoFi also offers automated savings features, allowing users to round up purchases or set up recurring transfers to savings. Plus, enjoy early paycheck access and instant transaction alerts to help manage your finances with ease.

Varo Bank Account Overview:

Varo is a mobile-first bank offering a single, streamlined checking account—officially called the Varo Bank Account—with no monthly fees, no minimum balance, and no overdraft charges. It’s designed for simplicity, early access to direct deposit, and seamless mobile management, all backed by national FDIC insurance.

Account Fees:

With Varo’s checking account, there are no monthly maintenance fees, no overdraft fees, no foreign transaction fees, and no transfer or card usage fees. However, you may encounter costs for out-of-network ATM withdrawals and third-party cash deposits. Cash advances and secured credit card services are available separately and carry their own applicable fees.

Perks & Benefits:

Enjoy early direct deposit—sometimes up to two days ahead of time—access to a wide ATM network (~40,000 fee-free Allpoint ATMs), mobile tools like spending insights and round-up savings, and optional high-yield savings with up to 5 % APY (when qualifying requirements are met). Varo also offers mobile cash advance options, a secured credit-builder card, and seamless digital convenience through its fully online platform.

BMO Checking Account Overview:

BMO offers a range of personal checking accounts designed for everyday banking, with options suited for students, low-fee seekers, and those with higher balances. Accounts can be opened online and are supported by user-friendly digital tools and nationwide ATM access.

Account Fees:

BMO Smart Advantage Checking has no monthly maintenance fee. BMO Smart Money Checking carries a $5 monthly fee, automatically waived for customers under 25. BMO Relationship Checking includes a monthly fee that can be waived by maintaining a minimum combined balance. Overdraft protection options are available, and standard ATM or service fees may apply depending on usage.

Perks & Benefits:

New customers may qualify for a $400 cash bonus by opening an eligible account and receiving at least $4,000 in qualifying direct deposits within 90 days. Additional benefits include mobile check deposit, bill pay, early direct deposit, and access to over 40,000 fee-free ATMs. Relationship Checking customers may receive extra perks like rate discounts and service fee waivers. All accounts include FDIC insurance up to legal limits.

TD Beyond Checking Account Overview:

TD Bank’s Beyond Checking account is designed for customers seeking premium features, rewards, and flexibility. It offers interest-earning capabilities, fee reimbursements, and added perks for those who maintain higher balances or set up qualifying direct deposits.

Fees:

- Monthly Maintenance Fee: $25, waived with $5,000+ in direct deposits, a $2,500 minimum daily balance, or $25,000 in combined eligible TD accounts.

- ATM Fees: Free at TD and non-TD ATMs with reimbursement for fees when a $2,500 minimum daily balance is maintained.

Perks & Benefits:

- Interest Earnings: Earns interest on account balances.

- Overdraft Payback: Automatically refunds the first two overdraft fees per calendar year.

- Free Services: Includes standard checks, money orders, official bank checks, stop payments, and one outgoing wire transfer per cycle.

- TD Early Pay: Access eligible direct deposits up to two days early.

- Linked Savings Benefits: Waives monthly fees on linked TD personal savings accounts.

CIT Bank eChecking Account Overview:

CIT Bank’s eChecking account is tailored for everyday banking needs, offering an interest rate of 0.25% APY¹ on balances over $25,000 and 0.10% APY on lower balances. It is designed for those who prefer online and mobile banking.

Account Fees:

Opening a CIT Bank eChecking account is free, though a $100 minimum deposit is required. There is no ongoing minimum balance requirement and no monthly maintenance fees. Additionally, there are no fees for online transfers or incoming wire transfers. CIT Bank also reimburses up to $30 per month for non-network ATM fees, making cash access more convenient. While overdraft protection is offered, applicable fees may apply.

Perks & Benefits:

Features include mobile check deposits, unlimited withdrawals, online bill pay, and transfers via Zelle®, Bill Pay, Samsung Pay and Apple Pay.² The eChecking account combines interest-earning potential, minimal fees, and digital banking tools.

Account Overview:

Upgrade’s standard Rewards Checking account is a no-fee online checking option that offers 1% cash back on everyday purchases. This rate applies to expenses such as gas, groceries, dining, and recurring payments like utilities and subscriptions. All other purchases earn 0.5% cash back. Unlike the Rewards Checking Plus account, this option does not require a qualifying direct deposit to access these rewards, making it a flexible choice for those who want consistent cash back benefits without additional requirements.

Fees:

No monthly fees, no minimum balance requirements, and no overdraft fees. Additionally, Upgrade charges no ATM fees for in-network transactions, but third-party ATM fees are not reimbursed under this account option.

Perks & Benefits:

Customers can enjoy early direct deposit, receiving their paycheck up to two days early. The account provides access to over 55,000 fee-free Allpoint® ATMs nationwide. Additional features include mobile check deposits, automated savings tools, and secure digital banking. All funds are FDIC insured up to $250,000 through Cross River Bank.

Account Overview:

Opening a Freedom Checking account with a Portfolio Savings account offers up to 3.60% APY.** Combining these accounts can increase your savings APY by up to 0.20%.** Additionally, the Freedom Checking account provides 2.00% APY.* (Checking rates 25x the national average.†) UFB Direct also features fewer fees and faster transaction processing.

Fees:

UFB Direct offers no monthly maintenance fees and requires no minimum deposit to open an account, making it an easy and cost-effective banking option for new customers.

Perks & Benefits:

Customers enjoy fee-free online and mobile banking services, such as mobile deposits, transfers, and bill pay. Move money instantly between your Portfolio Savings and Freedom Checking accounts. Account is FDIC insured up to the maximum allowance limit. Access to over 90,000 fee-free ATMs.

Cash Management Accounts

An Online Banking and Cash Management Alternative

The traditional way of thinking about banking is to have separate checking, savings, and investment accounts -- your bank handles the first two, and your brokerage firm would deal with the third. But some financial institutions are offering a new product that combines some features of all three: the cash management account. While it's technically a brokerage account, it's designed to enable consumers to handle their cash and make payments, all while earning interest. Offering a consolidated view from which to manage all your cash movements, these FDIC-insured accounts usually include a debit card, checkbook, and online bay pill services, just like a regular checking account. As an added bonus, though, you can also buy and sell shares. By eliminating the need to transfer funds between accounts, cash management accounts not only save time but also give users a clear, one-stop view of their money. Indeed, many consumers use them to bundle multiple investment accounts, thereby streamlining their finances and facilitating the implementation of financial strategies. While these accounts do pay interest, these are oftentimes a bit lower than those you can get with an online bank, though still higher than with a brick-and-mortar institution.

Many of the biggest players in Fintech have begun offering cash management accounts, such as SoFi Money, PNC, Chime, and Betterment. All four offer very reasonable minimum deposits of less than $25, and only PNC has a minimum account balance ($500).

What should I look for in a cash management account?

There are some basics you should make sure are included in your account:

- free debit card

- ATM access

- unlimited check writing

- easy access, either online or via app

Some firms go above and beyond the basics mentioned above to offer add-ons such as ATM rebates (mostly limited to specific networks in the US, though some do offer these worldwide), mobile deposits, account activity alerts, and links to external banks. This last feature is particularly useful since it means you can do even more to manage your money efficiently -- by depositing excess cash in an account with a higher APY, for instance.

What to keep in mind-

While cash management accounts have monthly fees, many have very low ones or eliminate them altogether, so make sure to read the fine print carefully. Since all these accounts are different, there may also be a minimum balance or deposit, or other requirements that can vary between providers. Additionally, keeping money in these accounts may mean limiting your higher-yield investments.

More insight into our methodology

Account Features

Banks have a wide variety of checking accounts available that can help you manage your money; the trick is finding the one that truly meets your financial needs while charging the lowest fees. These fees and features can vary widely so it's important to know what each account can give you (and charge you) before committing to one.

First, it's useful to know the types of checking accounts that are available, which include basic, free, interest-bearing, joint, and accounts for seniors or students. Basic checking accounts allow consumers to pay bills and own a debit card for transactions. Customers have a limited number of checks per cycle, and usually need a qualifying direct deposit transaction or consistent minimum balance in order to avoid maintenance fees. This type of account seldom earns interest. An interest-bearing checking account, on the other hand, typically pays interest once a month, but does assess a monthly maintenance fee and has a minimum balance requirement as well.

Free checking accounts are the most popular option available, and for good reason. Customers who select a free checking account will have no monthly maintenance fee and won't have to worry about keeping a particular minimum balance. Another option is a joint account, with two or more people who share expenses. These can be basic, free, or interest-bearing; it depends on the bank. This type of account is used mostly by couples and families. Finally, senior and student accounts are designed for people who meet the age requirement established by the institution (student accounts are typically for college-age customers). The perks vary by bank and can include free checks, discounts, and better rates on other products offered by the financial institution.

Fees & Restrictions

One of the most important aspects of choosing a checking account is knowing exactly the kind of fees that will be assessed and why.

The most commonly incurred fee is the maintenance fee. Unless they provide a free checking account, most banks will charge an either monthly or yearly maintenance fee. In most cases, this fee is charged if the account holder does not maintain a particular minimum balance in the account and/or does not sign up for direct deposit with the bank. Many online banks and credit unions are now offering accounts that do not charge this fee, however, even when the bank account has a very low balance.

There are other fees that apply even to free checking accounts however. One of them, the overdraft fee, is one that can affect your account in significant ways. First, it's essential to know your bank's policy on overdraft fees as some banks charge exorbitant fees for each overdraft - even if posted in the same day - which can lead many customers to face steep deficits in their accounts that are harder to recover from. If overdrafts are a worry, it's important to look for banks with a lower overdraft fee and a low maximum number of transactions per day that will incur a fee.

There are, of course, a number of other transactions that can also be charged by a bank, such as wire transfers, replacement cards, and obtaining additional checks, among others. It's important to assess your banking habits and see what is truly a deal-breaker when it comes to fees.

Support, Reputation, & Financials

One surefire way to understand how a financial institution works is by reading customer reviews. Potential customers can learn about bank practices and perks, as well as how current customers feel about the attention and care they receive at their bank. Agencies such as the Better Business Bureau (BBB) give customers an outlet to comment about a business, whether or not they are accredited by the organization. The BBB comments include positive, neutral, and negative reviews, and any complaints a company receives. The agency also reports on how quickly customer complaints on their website are handled and resolved.

With all the tools available today, it's easier than ever for customers looking to research financial institutions before committing to one. Customers can learn about a company's stability from federal and state regulators, as well as rating agencies, all of which offer in-depth looks at financial institutions. One of these regulating agencies, the Consumer Financial Protection Bureau (CFPB) establishes and enforces rules that protect consumers against predatory practices. On the agency’s website, consumers can access tools to help them manage their finances and can submit complaints and see first hand how companies respond.

Helpful information about Checking Accounts

These days, it might be more accurate to think of checking accounts as "spending" accounts. Gone are the days where it was necessary to write checks to pay for services, or where you had to wait in line at a bank to withdraw funds. Although you can still do this of course, debit cards, ATMs, and online banking have made paying with your checking account simpler than ever before. In fact, digital baking has become an essential part of everyday life.

Traditional checking accounts come with various fees, and most don’t gain interest like savings accounts do. Brick-and-mortar banks try to spice things up by offering a variety of perks for their checking accounts, but with the rates they offer, these are hardly enough. However, there is a cheaper alternative to traditional checking that offers better benefits.

Living in a digital age, it’s no surprise that people have embraced online banks. They offer the same benefits traditional banks do, but with some of the most competitive rates available. Online banks can do this because they don’t pay to maintain a physical presence, minimizing their operating costs. For checking accounts, they offer fewer and cheaper fees, along with additional features like increased interest rates, free online bill pay, and 24 hour access. Interest rates earned by online checking accounts are not as high as their online savings counterparts. However, some online banks do offer high promotional APYs, and because most online banks are insured by the Federal Deposit Insurance Corporation (FDIC), you can rest assured that all your funds are safe.

Now, there are some slight drawbacks to online banks. For one, not having a physical location means that all queries will need to be addressed online or by phone. Another drawback is that some online banks don’t offer direct ATM access, which means that customers rely on ATMs from other banks to withdraw funds, which may mean additional fees. However, online banks are aware of these inconveniences, and most take adequate measures to solve them, like having various means of communication (phone, email, live chat) and refunds in the case of ATM fees.

If you feel that online banking is right for you, your first step is to compare all of your available options. First, look for banks that offer high APY rates, but make sure you read their terms and conditions to know if these are promotional rates or if they depend on specific conditions. For example, some banks offer a high APY for a specific amount of time, but drop them afterwards. Others offer high APYs if your account balance is high, but discontinue it if you go below a specific number.

Next, compare the number of standard fees that come with the checking account, their costs, and if they waive options. Some online banks waive maintenance fees if you keep a certain balance, while others waive them if you deposit a specific amount per month. Also, check if there is a minimum balance requirement, if there are any added fees or penalties, and if they limit the amount of cash you can spend or withdraw daily. Keep an eye out for any additional features companies offer, such as free physical checks and debit cards, points or rewards systems, free online banking, and whether or not they have a mobile app.

If you withdraw money often, you should look for online banks that give you easy access to ATMs, or that can reimburse ATM fees. Some online banks are an extension of traditional banks, meaning that their ATMs and banks allow free in-person withdrawals. Other online banks partner with regular banks so that customers have access to their ATMs without fees. Some offer refunds for any fee customers have to pay, while others refund up to a certain amount per month. Always look for banks that have these features, since they guarantee a headache-free experience when withdrawing from your checking account.

FAQs about Checking Accounts

Can I have more than one checking account with my bank?

Can I open checking and savings accounts with different banks?

What is a checking line of credit?

Can I be turned down for a checking account?

What is a high-yield checking account and do I need one?

What should I do with my check after I deposit it online?

Do I need paper checks anymore?

How do I avoid monthly service charges?

Do online checking accounts have ATMs?

Are online checking accounts secure?

Secondly, your money is safe because all major online banks are insured by the Federal Deposit Insurance Corporation (FDIC). This agency was founded during the Great Depression when many banks failed and customers lost the money they had deposited.

Nowadays, if an FDIC-insured bank fails, the agency guarantees that the money in your accounts will be safe. One thing to keep in mind is that only the first $250,000 in any given account is secure. If your balance exceeds this limit, it may be a good idea to check with a financial advisor to find out how you can keep your money secure.