Ladder Life Insurance Review

Underwritten by Allianz Life Insurance Company of North America, Ladder Financial Inc. operates an online portal that was designed to offer simple, straightforward term life insurance coverage as quickly as possible. Some customers using the online application can get approved and covered within minutes. Any required medical examinations and labs are free and conducted by a traveling technician. The company does not charge fees, and is able to provide fast and inexpensive policies largely because they do not employ commissioned agents.

Ladder Financial Inc. is so named because of its policy of letting existing customers "ladder" their life insurance policies. Meaning you are allowed to easily decrease or increase your coverage during the term as your life situation changes, i.e. you pay off your mortgage and no longer need as much coverage.

Company Reputation

Founded in 1969 and based in Missouri, Ladder sells a variety of insurance products through a nationwide network of distributors, agents, and brokers. The company earns an excellent 4.8 out of 5-star rating on Trustpilot..One of the companies that backs Ladder life insurance policies, Allianz Life Insurance Company of New York, is highly rated by such organizations as A.M. Best and Standard & Poors. They have had just a handful of complaints filed against them with the NAIC, which is a significant achievement for companies their size.

One of the companies that backs Ladder life insurance policies, Allianz Life Insurance Company of New York, is highly rated by such organizations as A.M. Best and Standard & Poors. They have had just a handfull of complaints filed against them with the NAIC, which is a significant achievement for companies their size.

|

Standard and Poor’s |

AA |

|

Moody’s Rating |

NR |

|

A.M. Best FSR |

A+ |

|

|

Policies

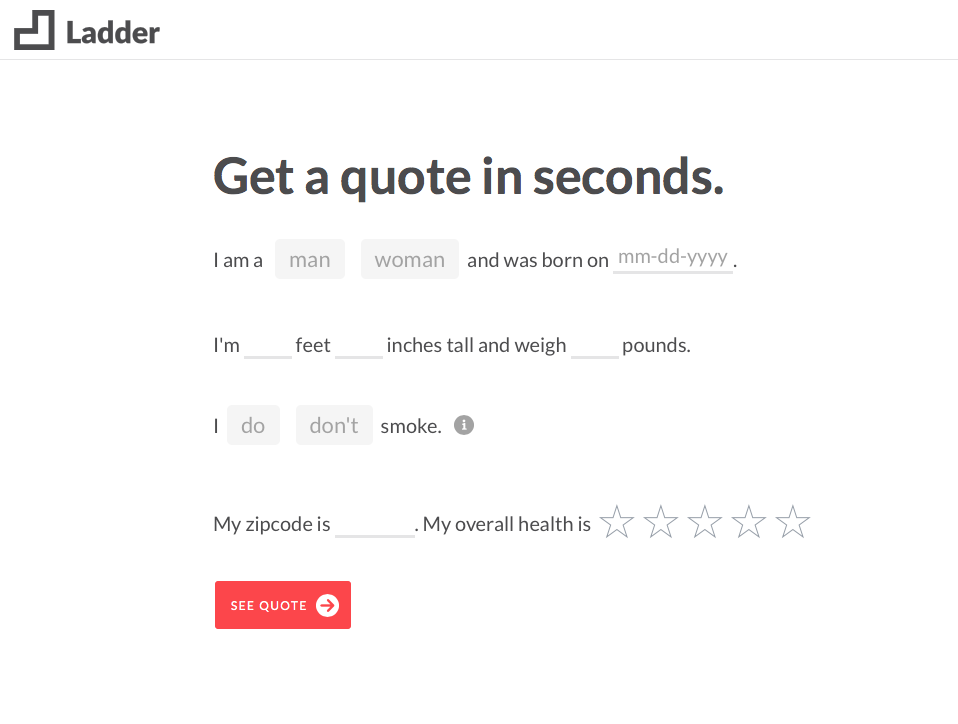

Ladder is not an online aggregator but offers its own policies backed by Allianz Life Insurance Company of New York and Allianz Life Insurance Company of North America. The company offers only term policies of 10, 15, 20, 25, and 30 years. There are no associated fees, and sales and customer support are staffed by salaried employees that do not work on commission. Also, as mentioned previously, Ladder is unique in that it lets you change the coverage amount on your policies at will. To start off your quote, Ladder will need the following information:

- Gender

- Birthdate

- Height and weight

- Smoker (yes or no)

- Zipcode

- Coverage Amount

- Term Length

To obtain a quote you will then be prompted to give your email and create an account

Sample Ladder Policy:

|

Ladder

|

|

|

Terms |

10, 15, 20, 25, and 30 years |

|

Coverage Limits |

$100,000 - $8,000,000 |

|

Guaranteed level premiums |

Yes, for the initial term |

|

Affordable Coverage |

Yes |

|

Savings based on Health |

Yes |

|

Death Benefit |

Yes |

|

Medical Exam |

Depends on customer |

Help and Support

Ladder offers first-class support from licensed life insurance professionals. Ladder's employees are salaried and not there to talk you into coverage you might not necessarily need. Representatives are reachable via email, chat, and social media.

Life Insurance with Ladder

Ladder term life insurance policies are available in all 50 states and the District of Columbia. The company was designed to provide customers quick, generic term life insurance coverage and a fully online experience. The ability to change coverage amounts is truly useful. After all, one will definitely find one's financial obligations to their family changing, especially over the course of a 25 or 30-year term. Mortgages get paid off, children graduate, etc. Changing coverage amounts cause premiums to fluctuate and could potentially save someone a lot of money. However, if you are in need of a policy that's more substantial, with investment components or additional riders, Ladder may not meet your needs.

Our Comments Policy | How to Write an Effective Comment

100% online process from start to finish for coverage up to $3M

- Instant coverage available for ages 20-60, if approved

- Adjust your coverage amount as your needs change and save on premiums

- Get a 30-day money-back guarantee and cancel anytime

- Coverage starts at just $5 per month