Sofi Money Personal Finance Tools Review

Breadth of Services

Sofi Lending, which owns the Sofi Money app, is a large, diversified financial services company. The app’s breadth of services reflects the capabilities of its sponsor company.

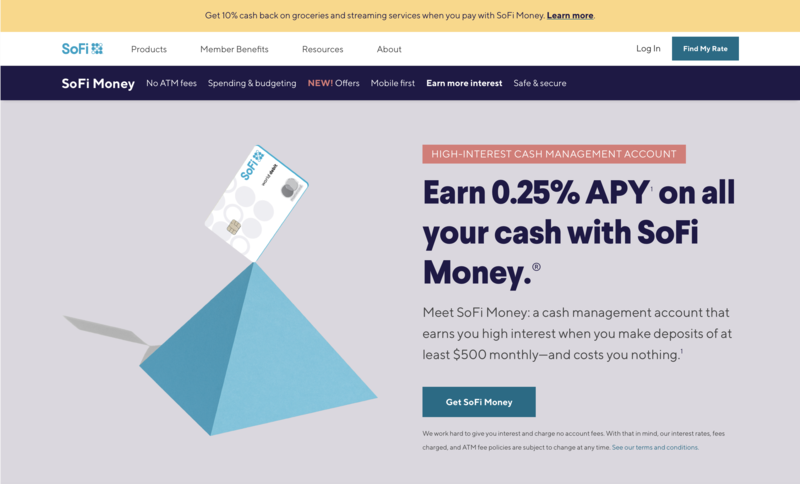

Users start out by opening a Sofi spending account. There is no minimum deposit required to do so, but you won’t earn but a negligible rate of interest on your deposits unless you make $500 in deposits monthly. Thereafter, the account offers a reasonably favorable rate (0.25%) that’s on part with traditional (non-high-yield) savings accounts. The nice thing about a Sofi spending account is that there are no monthly management fees to pay. ATM transactions are free at some 55,000 ATMs worldwide.

Screenshot from sofi.com/money August 24, 2020

Sofi Money helps users set up and track spending against a budget they can customize to match their own income, expense categories, investment, and savings goals. The app allows you to integrate both external accounts and other Sofi finance functions. It offers various investment options, including an automated investment feature. For users who favor a more passive investment approach, the Sofi Money app can recommend a starting diversified portfolio, help you continue to invest at a customized rate, and perform recommended functions like periodic portfolio rebalancing. The app provides these services free of charge. Many people pay high fees for investment services like these so Sofi Money is definitely a money-saving option. You can also set up a retirement savings account through Sofi Money and purchase and trade cryptocurrency.

When you use your Sofi debit card, you can earn revolving cash-back rewards that change monthly. When this review was written, Sofi members were eligible for 10% off on their grocery and streaming service expenses. Some past cash-back offers were brand-specific and included companies like Whole Foods, Trader Joe’s, Nike, and Warby Parker.

Screenshot from sofi.com/money August 24, 2020

Pricing

The Sofi app is free to use. However, to earn the highest interest rate they offer on the money you keep in your Sofi spending account, you must make a minimum deposit of $500 monthly. That’s pretty easy to achieve if you opt for direct deposit of your paycheck into your Sofi account. And Sofi’s spending account is an economical choice since it doesn’t charge monthly or ATM fees. If you don’t meet the $500 minimum, you will earn only 0.1% interest on your deposits.

Educational Materials

Sofi Money publishes an extensive blog where users can learn about a diverse range of topics related to financial wellness. The blog is organized into several sections and each is rich with information. By way of example, its career section alone has some 45 pages, each of which leads you to a handful of articles. The blog is regularly updated with current news so you can keep an eyes on financial markets, trends in your industry, and more. Since Sofi offers a number of financial products, the company also provides readers with guides to such instruments as mortgages, personal loans, and student loan refinancing. Articles are written in an engaging style and each is accompanied by an author profile so readers can gain further insight into each blog writers’ perspective.

Customer Experience

Sofi is a highly-diversified financial services company that offers a wide range of products. As such, the company does a great job of providing users with a broad financial worldview. The company’s website opens users’ eyes to financial services they could be using to strengthen their financial positions without being overly aggressive in its sales approach. Incidentally, we have reviewed some of Sofi’s other products and can also recommend them.

Sofi Money offers members a wide range of benefits which notably includes free, personalized financial coaching through its staff of advisors. We were also impressed by its career services benefit, also delivered individually to users through a career coach. Members can get help with transitioning from one job or career to the next, finding jobs in their field, and creating a personal brand. The company offers both phone and live chat consultations to make accessing these benefits easy.

Sofi Money prioritizes the security of its customers’ accounts. The app and its associated ATM card make use of chip card technology and two-factor identification. Users also have the option of using biometric identification to safeguard their accounts. Sofi Money monitors your account for any suspicious activity and alerts you to anything untoward. If trouble is detected or you lose your card, for example, you can instantly freeze your own account, without relying on the company to do so. Data your transmit through the Sofi Money app is encrypted using TLS (Transport Layer Security).

Sofi Money’s privacy policy is on par with the policies of other personal finance apps we’ve reviewed. They do not sell or rent customer data, but will use it in connection with providing the services you request and to market other products to you.

Reputation

Sofi receives an excellent 4.8 out of 5 rating from iOs users as compiled by the Apple App Store. Android users give it a 4.2 out of 5 rating. Users praise the app’s ability to integrate a wide range of accounts and service features and for providing sound education around financial topics. Sofi Money does receive some criticism for being cluttered and some users report that deposits take a long time to clear, as well.

Our Comments Policy | How to Write an Effective Comment

- Open a cash management account with no fees, ever

- Earn high interest with minimum monthly deposit of $500

- Revolving cash-back rewards on popular spending categories and brands

- Create a customized budget and track your spending

- Integrate investment and loan accounts for a broad view of your finances

- Wide range of financial education resources