Best Student Loans - June 2025

selected this partner

🥇Our #1 Choice for Students and Parents

- Lowest Rates - APR starting at 3.19%1

- Cover up to 100% of school costs

- Offers instant credit decision

- Apply online in less than 3 minutes

- No origination or prepayment fees

selected this partner

Sallie Mae

-

Rates starting at 3.19% APR1

-

Option to fund entire year (if approved)

-

Loans for part-time students are available

1Undergraduate Loan - Fixed rates 3.19% - 16.99% APR* with auto debit discount.

SoFi

- Fixed rates starting at 3.29% APR1

- No fees required

- No limit on covered expenses as long as they are school-certified

Ascent

- Fixed rates start at 3.39% APR1

- Students 4x more likely to be approved with a cosigner

- Receive 1% cash back of the total original balance when you graduate

Earnest

- Variable rates starting at 4.99%1

- Check your eligibility in just 2 minutes

- Quick and simple application process

Citizens Bank

- Fixed rates: 3.49% - 14.99% APR1

- 4x more likely to be approved by applying with a cosigner2

- No application or origination fees

selected this partner

🥇Our #1 Choice for Students and Parents

- Lowest Rates - APR starting at 3.19%1

- Cover up to 100% of school costs

- Offers instant credit decision

- Apply online in less than 3 minutes

- No origination or prepayment fees

selected this partner

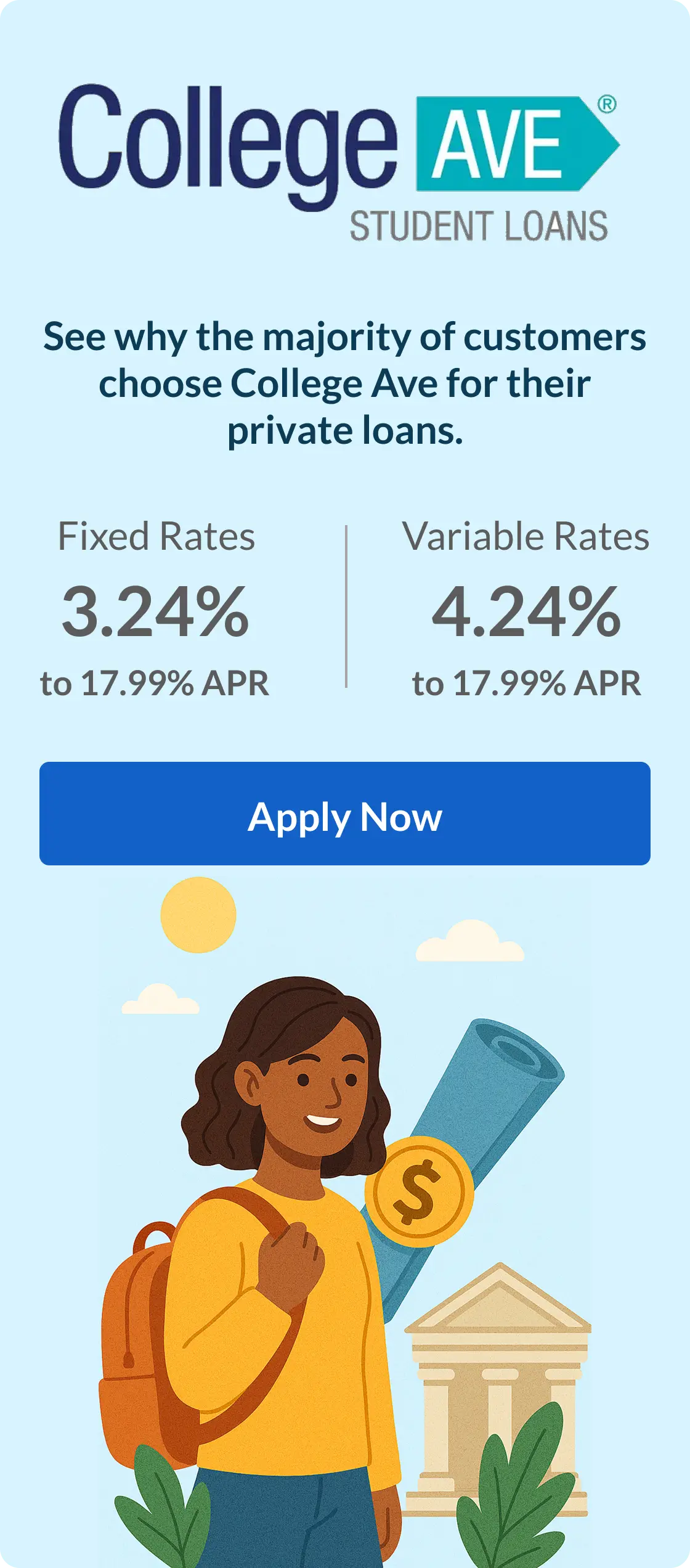

About College Ave Student Loans:

College Ave specializes in helping students and families access funding for higher education through flexible loan options. It has built a reputation for responsive customer service and user-friendly online tools. The lender provides clear information on rates, repayment plans, and borrower protections. College Ave offers loan products for undergraduate, graduate, and parent borrowers.

- What it covers

- Up to 100% of school-certified costs including tuition, fees, housing, books, and more.

- Rates

- Fixed and variable rate options available, with rates starting at 3.24% APR (with auto-pay discount).¹

- Fees

- No application, origination, or prepayment fees.

- Terms

- 5, 8, 10, 15, or 20 years

- Repayment Options

- Full deferment, interest-only payments, or flat $25/month payments while in school; Full principal and interest payments available immediately.

Cosigner Information:

Most undergraduate borrowers will need a cosigner. College Ave offers cosigner release after more than half the repayment term is complete and the borrower meets credit requirements.

Application Process:

The online application takes about 3 minutes. You can prequalify without impacting your credit score, and get an instant credit decision. A loan calculator helps estimate monthly payments based on your choices.

Best For:

College Ave is ideal for students and parents looking for customizable private loans with flexible repayment plans, competitive rates, and a quick, digital-first application experience.

About Sallie Mae Student Loans:

Sallie Mae stands out as a reputable private student loan lender, offering flexible financing solutions for undergraduate, graduate, and career training programs. With competitive interest rates and a range of repayment options, Sallie Mae empowers students and their families to tackle the cost of higher education with clarity and control.

- What it covers

- Covers up to 100% of school-certified expenses, including tuition, housing, books, and more.

- Rates

- Ffixed rates from 3.19%–16.99% APR or variable rates from 4.37%–16.49% APR, with a 0.25% discount for auto debit.

- Fees

- No origination fees or prepayment penalties; pay off your loan early without extra costs.

- Terms

- 10 to 15 years, depending on the loan amount and repayment plan.

- Repayment Options

- Select from deferred, fixed $25 monthly, or interest-only payments while in school, followed by a 6-month grace period post-graduation.

Cosigner Information:

Applying with a creditworthy cosigner may improve your chances of approval. Cosigner release is available after 12 consecutive, on-time principal and interest payments, pending credit review.

Application Process:

The application is quick and online, and you can view personalized rates and repayment options before you apply. Decisions are typically made within minutes.

Best For:

Sallie Mae is a strong choice for students and families looking for flexible loan options, competitive rates, and helpful features like cosigner release and automatic payment discounts.

About SoFi Student Loans:

SoFi offers private student loans with competitive rates, no fees, and flexible repayment terms for undergraduate and graduate students. With a strong emphasis on member benefits and financial tools, SoFi supports borrowers beyond the loan, helping them achieve long-term financial success.

- What it covers

- Up to 100% of school-certified expenses, including tuition, room and board, books, and other related costs.

- Rates

- Offers fixed or variable rates, plus a 0.25% discount for enrolling in autopay.¹

- Fees

- No origination or late fees.

- Terms

- 5, 7, 10, 15 or 20 years

- Repayment Options

- Offers multiple repayment options, including deferred, interest-only, and immediate full payments.

Cosigner Information:

Students can apply with a creditworthy cosigner to enhance approval chances. SoFi offers a cosigner release option after a specified number of on-time payments, subject to credit review.

Application Process:

The application is entirely online and can be completed in minutes. Borrowers can check their rates and terms without impacting their credit score, facilitating informed decision-making.

Best For:

SoFi is ideal for students seeking flexible private student loans with competitive rates, diverse repayment options, and added member benefits to support their financial journey.

About Ascent Student Loans:

Ascent offers private student loans for undergraduate and graduate students, with options for both cosigned and non-cosigned loans. They provide flexible repayment plans, competitive interest rates, and unique benefits like a 1% cash back reward upon graduation.

- What it covers

- Up to 100% of school-certified expenses, including tuition, housing, books, and other related costs.

- Rates

- Low fixed rates starting at 3.39% APR* and low variable rates starting at 4.70% APR*, with a 0.25% interest rate discount for enrolling in autopay.¹

- Fees

- No application, disbursement, prepayment or late fees.

- Terms

- 5, 7, 10, 12, or 15 years for undergraduates; graduate loans may offer different options.

- Repayment Options

- Up to 40 flexible repayment options.*

Cosigner Information:

Ascent allows borrowers to apply with or without a cosigner. For cosigned loans, borrowers may request a cosigner release after making 12 consecutive, on-time principal and interest payments and meeting credit and income requirements.

Application Process:

The online application process is straightforward and can be completed in about 3 minutes. Applicants can prequalify without impacting their credit score and receive instant credit decisions.

Best For:

Ascent is ideal for students seeking flexible loan options with or without a cosigner, competitive rates, and borrower-friendly benefits like cash back rewards and multiple repayment plans.

About Earnest Student Loans:

Earnest offers private student loans with customizable repayment options and no fees. Borrowers can choose between fixed and variable interest rates, and benefit from a 9-month grace period post-graduation. The application process is fully online, and Earnest evaluates applicants holistically, considering factors beyond credit scores.

- What it covers

- Tuition, books, laptops, study abroad, and other college-certified expenses.

- Rates

- ixed APRs starting at 3.24% with a cosigner; variable rates available.

- Fees

- No origination, late payment, or disbursement fees.

- Terms

- Loan terms ranging from 5 to 15 years, with a 9-month grace period post-graduation.

- Repayment Options

- Deferred, $25 fixed monthly payments, interest-only, and full principal & interest payments.

Cosigner Information:

While Earnest does not offer a traditional cosigner release program, borrowers can release their cosigners by refinancing the loan in their own name, provided they meet eligibility requirements. Applying with a cosigner can increase approval chances by up to 5 times and may result in lower interest rates.

Application Process:

The application is entirely online and typically takes a few minutes to complete. Applicants can check their rates without affecting their credit score. Most applicants receive a decision within 24 hours. Once approved, the loan amount is certified by the school, and funds are disbursed accordingly.

Best For:

Earnest is ideal for students seeking flexible repayment options, a user-friendly online application process, and the ability to customize their loan terms to fit their financial needs.

About Citizens Student Loans:

Citizens Bank provides a range of loan options for undergraduate, graduate, and parent borrowers, all supported by straightforward terms and flexible repayment plans. With a commitment to customer service and financial accessibility, Citizens Bank helps students and families navigate the cost of higher education with confidence.

- What it covers

- Up to 100% of certified education costs, including tuition, housing, and other school-related expenses.

- Rates

- Offers fixed or variable rates starting at 3.49% APR, with up to 0.50% in loyalty and auto-pay discounts.

- Fees

- No application, origination, or prepayment fees.

- Terms

- 5, 7, 10, 15, or 20 years

- Repayment Options

- Full deferment, interest-only, or $25/month payments while in school; full payments begin 6 months after graduation.

Cosigner Information:

Applying with a qualified cosigner can increase approval chances and potentially lower interest rates. Citizens allows for cosigner release after 36 consecutive on-time principal and interest payments, subject to credit and income verification.

Application Process:

The online application is quick and user-friendly. Applicants can receive a rate quote in about 2 minutes without affecting their credit score. Citizens also offers a Multi-Year Approval feature, reducing the need to reapply each year.

Best For:

Citizens Bank student loans are ideal for students seeking a flexible private loan option with competitive rates, multiple repayment plans, and a streamlined application process.