Best CDs of 2025

Open a Certificate of Deposit today to maximize your savings potential. Compare the best CD rates and account options available.

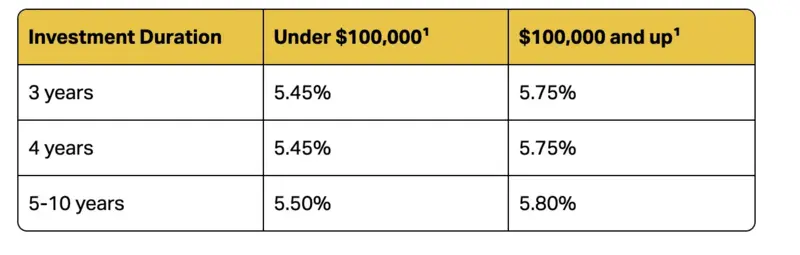

5.50%* fixed rate for your savings—start with just $1,000.

-

Earn 5.50%* APY on balances under $100,000

- Earn 5.80%* APY on balances $100,000 and greater

- Reliable Returns & Hassle-Free Enrollment

-

Withdraw up to 10% annually, penalty-free*

* Rate as of 08/01/2025

Earn up to 4.10% for terms from 3 to 60 months.

-

$1,000 min. opening deposit | $75,000 for jumbo CDs

-

Offer Regular & Jumbo CDs, and IRA certificates (Traditional, Roth, SEP).

-

Interest compounds monthly; optional monthly payouts reduce compounding benefits.

* Rate as of 08/01/2025

Federally Insured by the NCUA

Earn up to 4.20% APY* with Discover's®️ CD

- Locks in rates with the specific CD term that you choose

- Interest is compounded daily, and there are no account fees

- Hands off - Pick your term, make your deposit, and that's it!

*Rate as of 08/01/2025

Earn up to 3.50% APY* with CIT's CD

- Daily compounding interest to maximize your earning potential

- No penalty to access funds if needed before maturity

- $1,000 min. opening deposit

- FDIC Insured

* Rate as of 08/01/2025

Gainbridge® FastBreak™ Annuity Key Features:

- Issued by: Gainbridge Life Insurance Company

- Interest Rate & Terms: 5.80% guaranteed with 5-10 year terms¹

- Minimum Deposit: $1,000 – $1M

- Taxes: Interest taxable as earned

- Withdrawals: Up to 10% of account value each year²

Pros, Cons, and How it Compares:

The FastBreak™ annuity, offered by Gainbridge, is a non-tax-deferred savings product with a guaranteed annual percentage yield (APY) of 5.50%.¹ It is available in terms ranging from five to ten years and requires a minimum investment of $1,000.

Unlike tax-deferred annuities, FastBreak™ requires you to pay income tax on the gains credited to your account each year. While this means you don't receive the tax-deferred growth common with other annuities, it offers the advantage of flexibility. You can access your funds before age 59 ½ without incurring early withdrawal penalties, which is typically not an option with tax-deferred products. *Withdrawals above 10% free withdrawal amount are subject to a withdrawal charge and market value adjustment.

Who It's Best For:

According to Gainbridge, the FastBreak™ annuity is ideal for individuals focused on medium to long-term savings goals who want the flexibility to access their money if needed, before reaching retirement age. With its competitive APY and penalty-free early withdrawal feature, it’s a good fit for those seeking steady growth with financial flexibility.

Tiered Rates by Duration & Investment Amount: