Best Business Checking Accounts 2025

selected this partner

Up to 1.50% Cash Back* on Credit Cards

- No minimum balance

- Open up to 20 checking accounts

- Unlimited fee-free transactions & free incoming wires

- Online account integration with QuickBooks online & Xero

selected this partner

Earn a $500 sign-up bonus* after qualifying activities & up to 3.70% APY1

- Unlimited transactions & no fees for overdraft, ACH payments + wires

- AR & AP tools to manage invoices & vendor payments

- Add up to 20 sub-accounts with designated account numbers

- Up to $3M in FDIC Insurance—12x the national average

*Offer valid through 01/31/2026

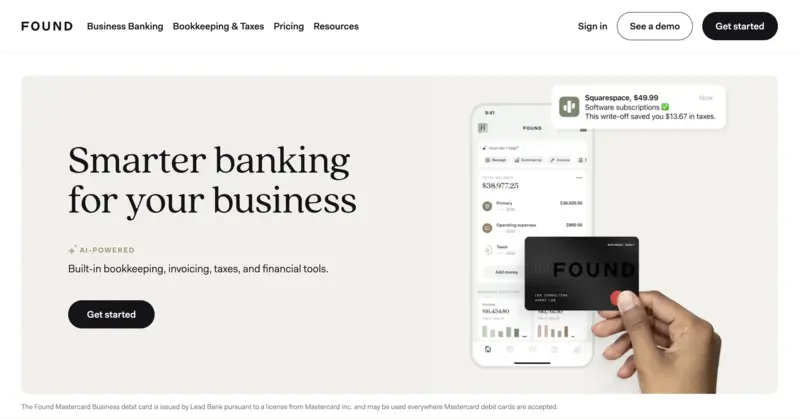

All-In-One Banking Platform

- No Minimum Balance or Required Monthly Fees*

- Manage Cash with Up to 10 Sub-Accounts

- Integrated Expense & Tax Management Tools

- Built for Small Business Owners

Earn $300 by Depositing $10k Within the First 90 Days*

- 1.50% Cash Back on Credit Spend1

- Open an Account with No Monthly Fees

- Access ACH Debit with a Paid Plan

- Earn Up to 4.09% yield with Mercury Treasury, offered by Mercury Advisory2

Earn Up to 1.55% APY with Innovator Checking1

- Unlimited 1% cash back2

- No monthly or overdraft fees

- Earn up to 3.30% APY with an Innovator Money Marketing Savings Account3

- Apply in as little as 5 minutes

Earn 3.00% APY on Your Business Savings1

- Live Customer Support 7 Days a Week

- FDIC Insured up to $3M

- International Wires Available in 24 Hours

- Integrated D&B Reporting

$0 Non-Sufficient Funds Fees

- No Minimum Deposit Required

- Access to $90k+ ATMs Globally

- Get Auto-rebates with Mastercard® Easy Savings

Earn Up to 3.00% APY* on Your Balance

- Instant Deposits from Square, PayPal, Venmo & More

- No Min Balance Required, No Overdraft Fees

- Earn Up to 4.0% Automatic Rebate on Select Categories

Earn Up to 1.01% APY with Business Interest Checking

- Get up to $400 Welcome Bonus1

- Open a Business Interest Checking With $100

- Unlimited Domestic ATM Reimbursements

- Up to 50 Free Non-deposit Transactions Per Month

1Offer ends 06/30/2024. Use code NEW400

Unlock 3 Months of Free Bookkeeping

-

No monthly fees or minimum balance required

-

Send unlimited invoices and payments at no extra cost

-

Access up to $1B in loans from 20+ trusted lenders

-

Capture receipts & track profit/loss in real time

-

FDIC insured up to $3M

selected this partner

Up to 1.50% Cash Back* on Credit Cards

- No minimum balance

- Open up to 20 checking accounts

- Unlimited fee-free transactions & free incoming wires

- Online account integration with QuickBooks online & Xero

selected this partner

Relay Business Account Overview

Relay is an online business banking platform built to give small business owners greater visibility and control over their finances. Users can open up to 20 checking accounts and 2 savings accounts, issue physical or virtual debit cards, and manage all business payments and deposits—including ACH, wires, checks, and transfers from platforms like PayPal and Stripe—through one dashboard.

Fees & Requirements

Relay has no monthly fees, overdraft charges, or minimum balance requirements. Accounts can be opened online with no credit check. The platform offers a free plan and optional paid tiers with added features like same-day ACH and higher savings rates. Banking services are provided by Thread Bank, Member FDIC, with deposits eligible for up to $3 million in FDIC insurance through a partner sweep program.

Perks & Benefits

Relay offers flexible tools to simplify cash management. You can automate transfers between accounts, set spending rules for team cards, and manage user permissions. Savings accounts earn up to 2.86% APY, and integrations with QuickBooks, Xero, Gusto, and Plaid help streamline accounting. Additional features include bill pay, receipt tracking, and real-time cash flow insights.

Bluevine Business Account Overview

Bluevine offers an online business checking account designed for small business owners who want flexible, modern banking. Manage deposits, payments, and sub-accounts in one dashboard, issue multiple debit cards, and enjoy unlimited transactions on desktop or mobile. It’s built to simplify cash flow management and daily operations.

Fees & Requirements

Bluevine has no monthly fees, overdraft charges, or minimum balance requirements. You can open an account online with no credit check, and standard ACH transfers are free. Deposits are FDIC insured up to $3 million through partner banks. Interest can be earned by meeting simple monthly activity requirements like card spending or receiving payments.

Perks & Benefits

Bluevine offers competitive yields—up to 1.3% APY on balances up to $250,000 with the Standard plan and up to 3.5% APY with upgraded plans. You can create sub-accounts for budgeting, automate transfers, and send payment links directly from your account. The platform integrates with QuickBooks and Xero, provides free access to 37,000+ MoneyPass® ATMs, and includes team spending controls and priority support for higher-tier users.

Found Business Account Overview

Found is an online business checking account built for freelancers and self-employed professionals who want simple, all-in-one money management. It combines banking, bookkeeping, and tax tools so users can track income, send invoices, and manage expenses from one dashboard. You can open an account in minutes, create virtual cards, and set aside funds for taxes or savings using customizable “Pockets.”

Fees & Requirements

Found has no monthly fees, overdraft charges, or minimum balance requirements. ACH transfers are free, and no credit check is required to open an account. Deposits are FDIC insured up to $250,000 through Found’s partner bank. Users can upgrade to Found Plus for $19.99 per month or $149.99 per year to access enhanced features and higher transfer limits.

Perks & Benefits

Found simplifies business finances with built-in bookkeeping and tax tools that automatically categorize expenses, estimate taxes, and generate a Schedule C. Users can send unlimited invoices, pay contractors, capture receipts, and connect payment apps like PayPal, Venmo, and Square. Found also offers early direct deposit access, smart virtual cards with spend controls, and automation tools to help self-employed professionals stay organized and tax-ready.

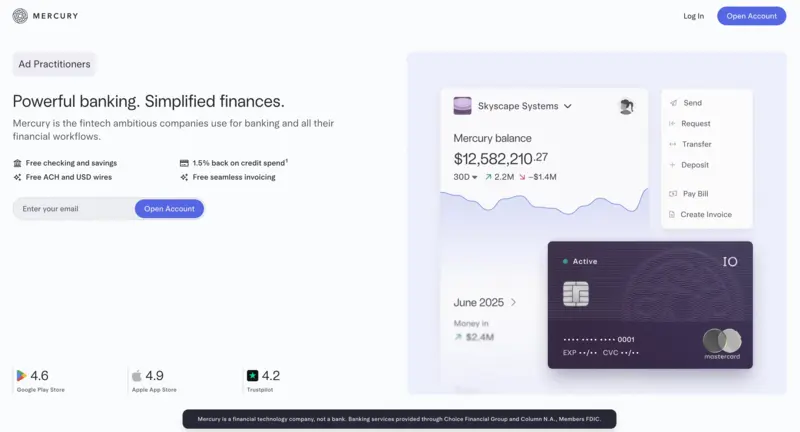

Mercury Business Account Overview

Mercury offers online business checking and savings accounts designed for startups and small businesses that value speed, transparency, and modern tools. You can manage deposits, payments, and transfers in one dashboard, issue virtual and physical debit cards, and grant controlled access to team members. The platform integrates with tools like QuickBooks, Xero, Stripe, and PayPal for streamlined financial management.

Fees & Requirements

Mercury has no monthly fees, overdraft charges, or minimum balance requirements. ACH transfers and domestic wires are free, and there are no limits on standard transactions. Accounts can be opened entirely online in minutes, and deposits are held with FDIC-insured partner banks, eligible for up to $5 million in coverage through a sweep program.

Perks & Benefits

Mercury provides advanced tools like automated transfers, bill pay, and virtual cards with spending controls. Businesses can manage multiple users, customize permissions, and use built-in integrations to sync data across accounting and payment platforms. The platform also offers treasury options for earning yield on idle funds and access to resources such as investor connections and venture financing tools.

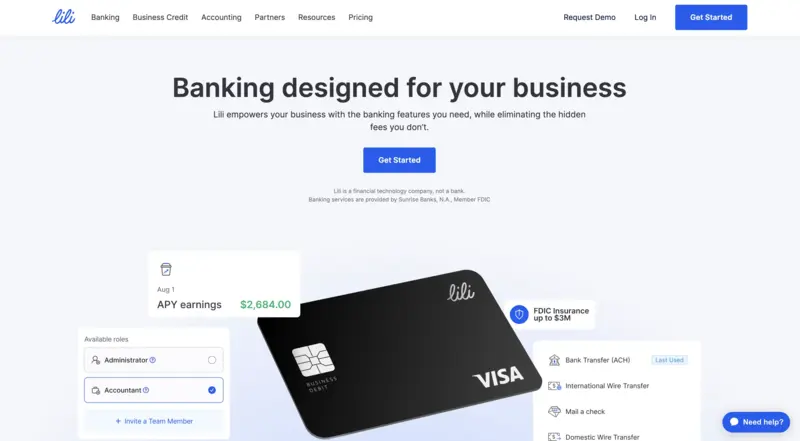

Lili Business Account Overview

Lili is a mobile-first business checking account crafted for freelancers and small business owners who want integrated banking, tax, and expense tools. You can open an account quickly, manage income and expenses from one app, issue a business debit card, and set aside funds for tax obligations using built-in “Buckets.”

Fees & Requirements

Lili’s Basic plan has no monthly fee, no minimum balance, and no credit check required to open an account. ACH transfers are free, and deposits are FDIC insured through a partner bank. Optional premium plans unlock additional tools for a monthly or annual subscription fee.

Perks & Benefits

Lili stands out with expense categorization, automated tax savings, and invoice tools built directly into the app. You’ll receive direct deposits up to two days early, access fee-free ATM withdrawals via a large network, and benefit from international wire capability on certain plans—all within a streamlined digital platform designed for solo-business operators.

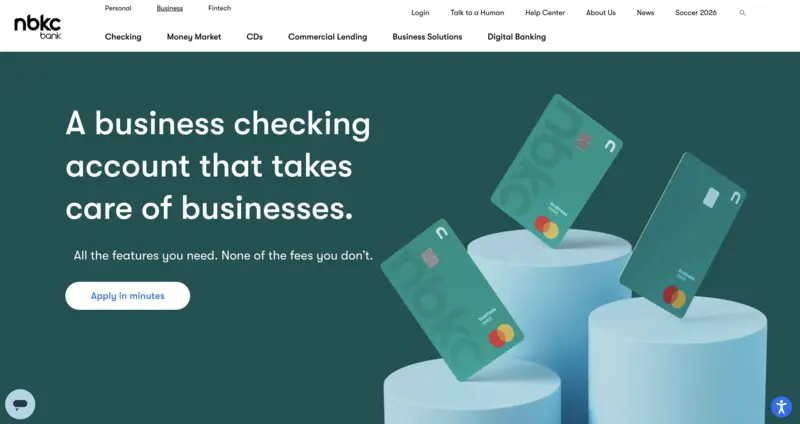

nbkc Bank Business Checking Account Overview

nbkc Bank offers an online business checking account designed for small businesses seeking straightforward, flexible banking. You can open an account online, use a physical or virtual debit card, and manage deposits, payments, and transfers via mobile or desktop—all within one account.

Fees & Requirements

nbkc Bank’s business checking account carries **no monthly maintenance fee** and requires no minimum balance. Domestic ACH and most deposit services incur no extra fees; certain cash services or special wires may have standard per-item charges. The account can be opened online in a few minutes, and deposits are FDIC insured through nbkc Bank, Member FDIC.

Perks & Benefits

The account includes unlimited transactions at no additional cost, which is especially helpful for businesses with varying payment volumes. You’ll receive free standard ACH transfers, enjoy access to mobile check deposit and remote banking tools, and benefit from online account opening.

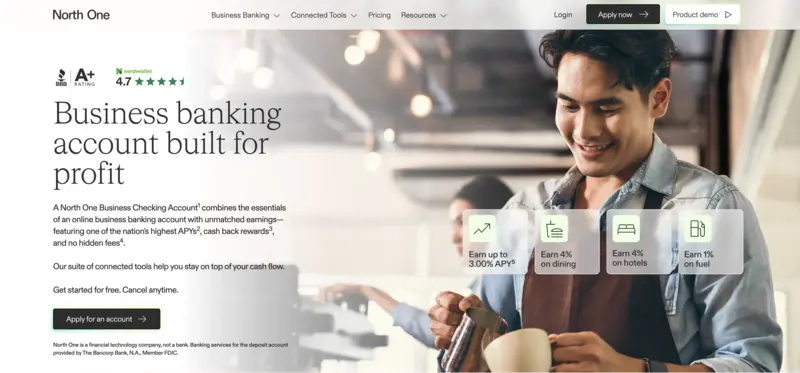

NorthOne Business Account Overview

NorthOne is an online business checking account built for freelancers, startups, and small business owners looking for streamlined digital banking. It offers a mobile-first experience with features like unlimited “Envelopes” to segment funds for taxes, payroll or rent, integrations with payment platforms (Stripe, PayPal, Shopify) and accounting tools, and physical or virtual debit cards issued for your team.

Fees & Requirements

The Standard account charges a monthly fee (around $10), with no minimum balance or monthly maintenance fee beyond that. ACH deposits and standard transfers are included, while same-day ACH and wire transfers may carry fees or require an upgraded plan. Accounts are opened online, generally in minutes, and deposits are FDIC-insured through partner bank arrangements.

Perks & Benefits

NorthOne offers unlimited transactions, including deposits, transfers and purchases, all without incremental charges on the base plan. It supports real-time syncing with many business apps, allows you to set auto-rules to funnel money into various Envelopes, and offers a large nationwide ATM and cash-deposit network via partnerships.

Axos Bank Business Account Overview

Axos Bank offers digital business checking options tailored for small businesses and startups seeking flexible, modern banking. With the Business Interest Checking account you can earn interest on balances, use debit cards, access unlimited domestic ATM fee reimbursements, and manage your account entirely online.

Fees & Requirements

The Business Interest Checking account has a $10 monthly maintenance fee which is waived if you maintain a $5,000 average daily balance. Opening the account requires a minimum deposit, and you must stay under certain transaction limits before extra charges apply. Deposits are FDIC insured, and there are unlimited domestic ATM fee reimbursements. There are monthly free transaction limits before per-item fees.

Perks & Benefits

Key perks include the ability to earn up to about 1.01% APY on balances (for certain tiers), unlimited domestic ATM fee reimbursements, 50 free checks at account opening, and integration with accounting tools like QuickBooks. The digital-only model offers strong online access, and the bank also provides enterprise-level business banking services for companies that scale.

Holdings Business Account Overview

Holdings is a digital-first business banking platform that combines high-yield deposits, cash management, and accounting tools in one place. Built for small businesses and entrepreneurs, it offers unlimited transactions, virtual debit cards, and a unified dashboard for managing cash flow, invoices, and expenses.

Fees & Requirements

Holdings has no monthly maintenance fees, no minimum balance requirements, and no fees for ACH or wire transfers. Accounts can be opened online and are backed by FDIC-insured partner banks, with coverage of up to $3 million through a sweep network. Eligible balances can earn up to 3.0% APY, depending on tier and plan type.

Perks & Benefits

Holdings offers integrated bookkeeping, automated expense tracking, and seamless connections to leading accounting platforms. Users can create and manage invoices, schedule payments, and organize finances directly within the platform. With high-yield savings, fee-free banking, and comprehensive financial tools, Holdings simplifies business banking for growth-focused companies.